602-Asset Protection Planning for Mere Mortals - Part 2 - The Morality and Legality of Asset Protection

In this episode of the podcast we tackle these two questions:

- Is it legal to engage in asset protection planning?

- Is it moral to engage in asset protection planning?

Short answer? Yes and yes. If that's enough for you, just skip listening to this episode. But if you'd like a bit more texture to the discussion, enjoy the podcast for a discussion of the legality and morality of asset protection planning.

Joshua

p.s., if you missed Part 1 of this series, start there.

601-Asset Protection Planning for Mere Mortals - Part 1

Here at RPF, I strive to keep you focused continually on the Radical Personal Finance "Framework For Wealth." This is a helpful framework for you to use to organize the financial planning suggestions you are given as well as the specific actions you can take to build your wealth as you work towards financial independence.

(After all, it's action that counts. Only action leads to change. Thoughts and philosophy are nice, but you have to act.)

That Framework for Wealth is quite simple:

- Increase Income

- Decrease Expenses

- Invest Wisely

- Avoid Catastrophe

- Optimize Lifestyle

Today, we focus on Avoiding Catastrophe as we broach the topic of Asset Protection planning.

There are many ways we can conceive of "Asset Protection Planning." The common use of the term involves legal planning that helps to insulate various assets from the legal claims of creditors through the use of exemptions and legal entities such as corporations and trusts.

I'm fine with this being the primary use of...

593-Lifestyles of the Frugal and Obscure

The Lifestyles of the Rich and Famous might make good TV but it's the Lifestyles of the Frugal and Obscure that makes for wealthy people who keep their money.

Joshua

- If you're interested in learning how to borrow money safely and never paying interest with credit cards, go buy my new course! www.radicalpersonalfinance.com/creditcardcourse

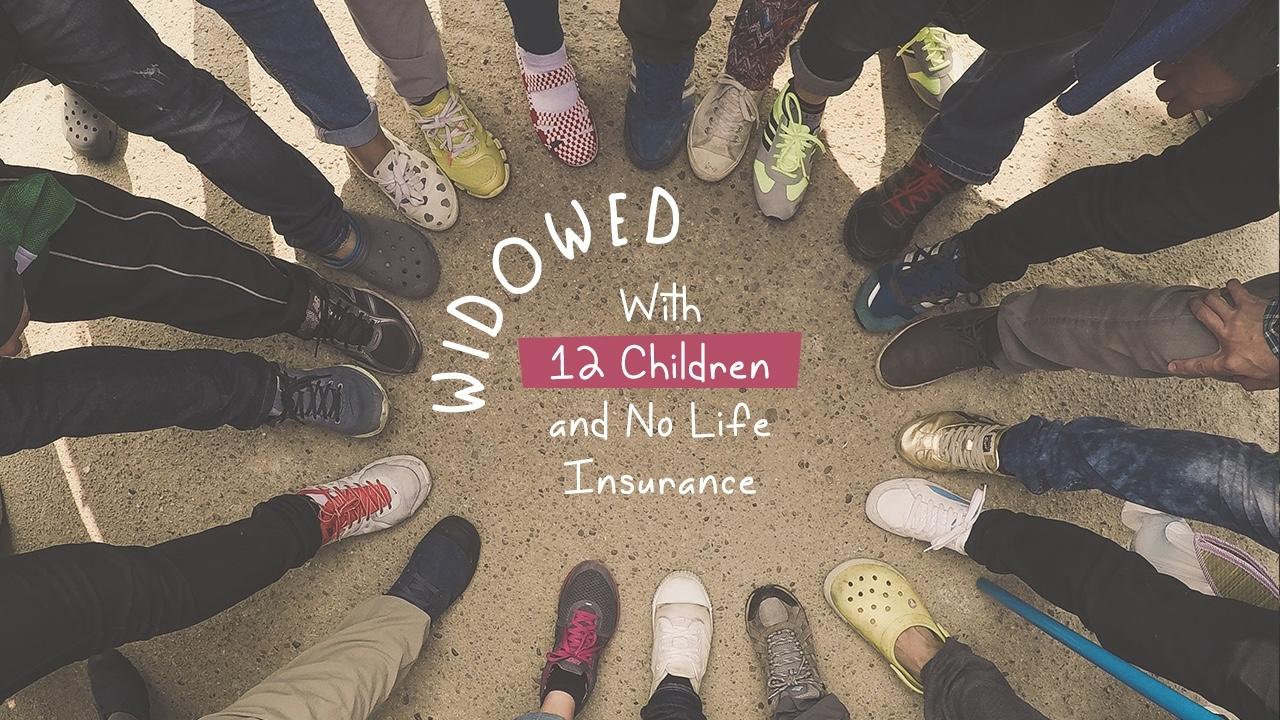

592-Widowed With 12 Children and No Life Insurance! One Woman's Story.

What do you think would happen to a mother of 12 who was widowed at a fairly young age and whose husband didn't have any life insurance? Could she survive? If so, how?

Today, I want to share with you the story of a friend of mine who went through that precise circumstance. I hope you enjoy it!

Joshua

588-Credit Card Loans Can Provide a Way to Privately Purchase Goods and Services

One of the most under-appreciated aspects of credit cards is the significant privacy they can afford you. Listen to the show for details.

Remember, please sign up for my new credit card course: www.radicalpersonalfinance.com/creditcardcourse

Use coupon code "CREDITCARDTEN" to save $10 off the price. (Good until 10/15/18.)

Thank you!

Joshua

587-Credit Card Debt Is a Very Safe Form of Debt

One of the most useful aspects of credit cards is how safe the debt is when compared to other forms of debt. Enjoy this excerpt from my brand new course called "How to Borrow Money Safely and Never Pay Interest Using Credit Cards."

The course is now available for you to buy. Go here: www.radicalpersonalfinance.com/creditcardcourse

Use the coupon code "CREDITCARDTEN" to save $10 off the price. (Valid until 10/15/18.)

Thank you!

Joshua